By Alex Brunicki and Henry Ang, first published 19th August 2024.

TLDR: BACKED VC are actively investing at seed in frontier technology, with blockchain a core focus area. Right now our thesis is to back founders who are building key infrastructure and building better applications.

Why Blockchain?

At BACKED, we see blockchains as an expression of permissionless access, censorship resistance, and self-custody. We believe that everyone should have the right to asset ownership, and open participation in networks that facilitate value transfer.

The Past, The Present & The Future

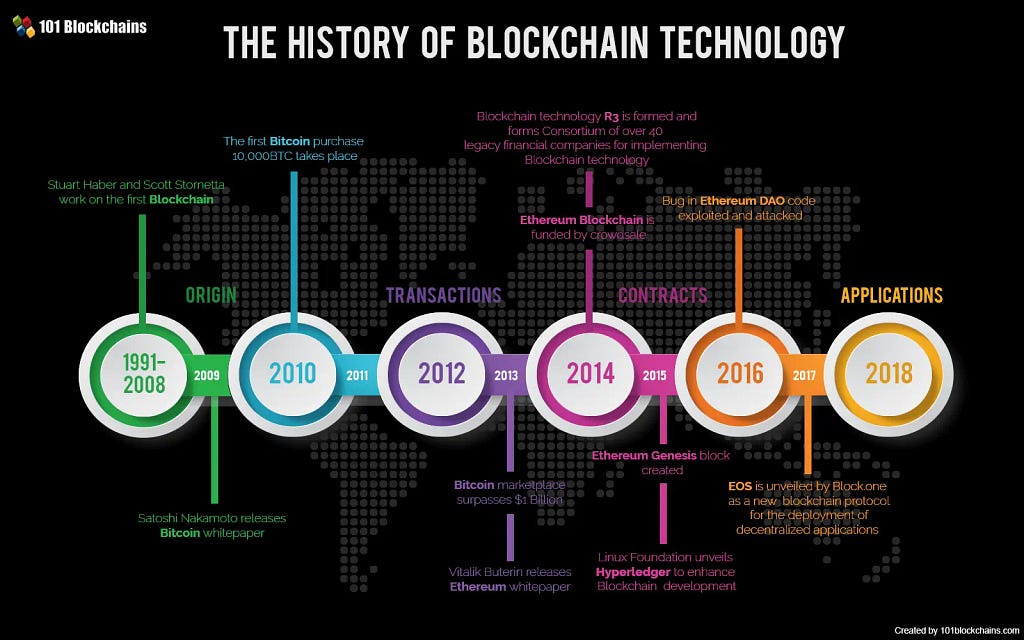

Over the past 15 years, blockchains have evolved significantly. Bitcoin was launched in 2009 as an alternative store of value against global currency debasement in the wake of the global financial crisis, while Ethereum introduced programmability to blockchains in 2015 through smart contracts which led to the creation of Decentralised Finance.

As on-chain activity surged, newer blockchains like Solana, Avalanche, Aptos etc. made innovations in consensus algorithms, execution environments and smart contract programming languages to improve the throughput capability of blockchains, with the hope of supporting billions of users in the near future.

Our Thesis

Our core investment thesis is to back founders that are:

(a) building key infrastructure that addresses scalability bottlenecks, smart contract safety, self-custody accessibility, interoperability and privacy, which we think are crucial to onboard the next wave of users, and

(b) building better applications that use blockchain and/or tokenomics as their core value proposition, which can then drive user adoption

Breaking down the investing landscape, we view it through two broad buckets: Infrastructure and Applications.

(a) Infrastructure

What We See

We think that infrastructure is over-invested and over-valued. Although it has greater developer mindshare, there is less net new innovation, but rather incremental improvements on existing infrastructure.

Our Hypothesis

Infrastructure will become a highly commoditised market and most existing infrastructure will not find the required developer adoption and user adoption to make the higher initial valuations economically worthwhile. There will be best in class winners for each sub-component (i.e. execution, settlement, data availability etc.) and vertical (e.g., Immutable X for gaming) but investment returns for projects that only have incremental improvements will no longer be attractive. Eventually funds will start allocating less capital to these opportunities and developer interest will center around the winning infrastructure.

Our Strategy

We will spend less time pursuing infrastructure at this part of the cycle, but will continue to invest in net new innovation at the right price point. . We further expand the type of infrastructure we are most interested in below.

(b) Applications

What We See

The application layer receives less attention, potentially because the margin of error is much thinner: an inability to find early product market fit leads to failure. It can also be said that the defensibility of application layer projects is more challenging to build.

Our Hypothesis

We think that blockchains are tools, and value accrual will eventually happen at the application level. We think that valuations will eventually adjust and reflect fundamentals in the long run

Our Strategy

We will spend more time at the grassroots level, e.g. meeting early stage founders at hackathons. We will be strategic with our ecosystem selection in domains we think present a higher probability of a breakthrough application (i.e. Solana, Ton, Base).

(a) Sub Verticals: Infrastructure

1. Best-in-Class Verticals

2. Interoperability

3. Privacy

4. Self Custody

5. Risk Management Tools

1. Best-in-Class Verticals

What is it?

Specialised infrastructure with features purpose built for the vertical they are targeting. E.g. Gaming focused chains like Immutable build a gamer-centric community and features such as account abstraction wallets that help easier onboarding of gamers into crypto.

Why invest in it?

Blockspace is a scarce resource within blockchains and general purpose blockchains are unable to fulfill all demand, especially during spikes of activity. Specialised infrastructure can provide dedicated blockspace to a same set of use cases while retaining composability such that. E.g. Immutable provides blockspace specifically for gaming use cases, and gamers have the ability to access a single market place to transfer asset value across different games.

What we are looking for

Net new innovation that provides a new design space for builders to experiment with.

Some immediate areas include elastic roll ups that expand blockspace on demand without sacrificing composability, regulatory compliant chains that enable CeFi x DeFi etc.

Companies we have invested in:

2. Interoperability

What is it?

Interoperability is the ability to move assets from different blockchains that have different asset standards.

Why invest in it?

We are moving towards a multi-chain architecture and there needs to be more secure ways to move assets between different ecosystems, and existing bridges have been highly prone to hacks. Greater interoperability can also provide a gateway for enterprise blockchains to interact with public blockchains.

What we are looking for

Bridging solutions that can offer immediate liquidity and access to a variety of blockchains

Roll up specific solutions that allow users to move assets freely across the Ethereum roll up ecosystem

3. Privacy

What is it?

Blockchains have the unique property of transparency where every activity can be traced on-chain. Privacy solutions enable users to have greater control over the data that they share publicly on-chain.

Why invest in it?

As it stands today, it is hard to envision enterprise adoption of public blockchains if an organisation’s activities can be front run or monitored. Providing a privacy solution for enterprise use cases will enable greater adoption of public blockchains, leading to greater composability across both the public and private sectors.

What we are looking for

We are excited about the advancements in Fully Homomorphic Encryption that enable computation to be done on encrypted data, which we believe is key to helping users achieve trust minimisation and privacy.

4. Self Custody

What is it?

Self-custody enables users to take full control of their own assets. While this enables more freedom, it has often resulted in loss of funds when users forget the “keys” to their own assets.

Why invest in it?

This is a huge bottleneck in terms of blockchain adoption, as users are not well equipped to manage their own assets. Better self custody solutions will enable more value to be stored on-chain.

What we are looking for

Technical designs have largely settled on account abstraction, MPC and multi-sig set ups. Differentiators will come in the form of UI/UX improvements, along with trustless integrations with on-chain applications (e.g. Safe on ETH, Squads on Solana)

Companies we have invested in:

- Ultimate Wallet (acquired by Jupiter)

5. Risk Management Tools

What is it?

Risk management can come in the form of smart contract safety, sustainable tokenomics design, or agent-based simulation to prevent protocol exploits.

Why invest in it?

Loss of user funds is top on the priority of most protocols, and there is no strong practice within the industry to guard against it.

What we are looking for

Companies that utilise AI to help write safer smart contracts

Companies that uses agent-based simulations to stress test protocol parameters to prevent exploits (e.g. oracle mispricing) or simulate a healthy token economy (e.g. Luna’s death spiral)

Smart contract audit software / firms.

(b) Sub Verticals: Applications

1. DePin

2. Payments

3. DeFi

4. TradFi x DeFi

5. DeSci

6. Consumer

7. Artificial Intelligence

1. DePin

What is it?

DePin, also known as decentralised physical infrastructure networks, utilises token incentives to reward early participants that help address the cold start problem of bootstrapping a new resource network. Examples include Helium (decentralised wireless networks), Render (decentralised GPU), Hivemapper (decentralised mapping)

Why invest in it?

While it may not outcompete incumbents, capturing a % of market share as a redundancy alternative will make a compelling investment case.

What we are looking for

Storage in particular looks underserved, with incumbents more geared towards immutable storage (Arweave, Filecoin). We see a gap for players working on mutable storage / decentralised databases.

Companies that we have invested in:

2. Payments

What is it?

Payments via blockchain rails have been touted as an obvious use case but have not achieved much traction despite cheaper transaction costs, faster settlement times and global reach.

Why invest in it?

We believe that a shift in regulation (which is already happening) will present tailwinds for this vertical.

What we are looking for

Stablecoin issuers, especially in jurisdictions where local issuers are preferred would be a compelling.

B2B Cross border payment solutions that have regulated on and off ramping capabilities, and the ability to integrate into accounting and compliance workflows of businesses will be another focus area.

Companies that we have invested in:

- Onramper (acquired by MoonPay)

3. DeFi

What is it?

DeFi, also known as decentralised finance, is a way for anyone to have permissionless access to financial products through a self custody wallet.

Why invest in it?

With improvements in blockchain throughput and latency, we are seeing a new wave of DeFi applications that can compose with each other. The permissionless and global nature of a decentralised financial system presents a huge market for successful applications

What we are looking for

Apart from traditional money markets, we are looking out for new innovations in AMMs, Perpetual Dexes, Front ends (aggregators), Market-making vaults and Liquidity vaults.

Perpetual Dexes in particular is underserved; they only make up 1.5–2% of the volume on centralised exchanges, which accounts 70% of the traded volume on them.

Central Limit Order Books is another area that has been enabled more recently by blockchain scaling advancements and has capital efficiency benefits that could bring more market makers on chain.

Companies that we have invested in:

4. TradFi x DeFi

What is it?

This is a unique intersection between DeFi and Traditional Finance, where institutions might want DeFi exposure, but in a regulatory compliant way. An example would be that of Onyx by JPM, or Project Guardian by the Monetary Authority of Singapore.

Why invest in it?

With the approval of BTC ETFs, we should see increased institutional adoption in blockchains. While we do not think institutions will dive straight into DeFi, we can see them experimenting with RWAs, on-chain yields within permissioned sandboxes which then connect to public blockchains via bridges (e.g. Onyx by JPM).

What we are looking for

Services and platforms that help institutions manage digital assets in a compliant way will be huge beneficiaries.

Companies working on asset tokenisation will also be another key focus.

Companies that we invested in:

5. DeSci

What is it?

DeSci, known as Decentralised Science, aims to utilise the collaborative and decentralisation ethos of crypto to orchestrate funding, research, and dissemination of scientific knowledge.

Why invest in it?

There are potential synergies with Backed’s expertise in Bio and we believe crypto incentives can help coordinate DAOs to drive this sector forward.

What we are looking for

We keep an open mind to founders working on this, with a focus on areas where we have expertise in internally.

Companies that we have invested in:

6. Consumer

What is it?

This is a broader sector which seeks to bring mass market participants into Web3 (e.g. decentralised social and gaming)

Why invest in it?

There is a growing focus on ownership amongst consumer (e.g. data ownership with social media, asset ownership with games), and we are one breakthrough app away from bringing more people on-chain.

What we are looking for

We aim to be highly selective with such projects, placing a high bar on not only great products but also business models that scale.

Companies that we have invested in:

- Sky Mavis

- Immutable

- Footium

- Eve Online

- Infomon

7. Artificial Intelligence

What is it?

AI has many benefits when it comes to increasing productivity, and its an emerging sector alongside Web3.

Why invest in it?

AI benefits from colocation of compute which is naturally centralising force, and we think Web3 could be the solution to a more “open” AI.

What we are looking for

We are keen on teams working on bringing auditability and verifiability of the data used to train such models. We think that provenance and ability to trust the models we use should be a given.

Companies that we have invested in:

Thanks for reading. Our investment theses are regularly updated, so follow LinkedIn and X to stay tuned.

In the meantime, learn more about our blockchain investments here.